Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Policyholder Information Clerk position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

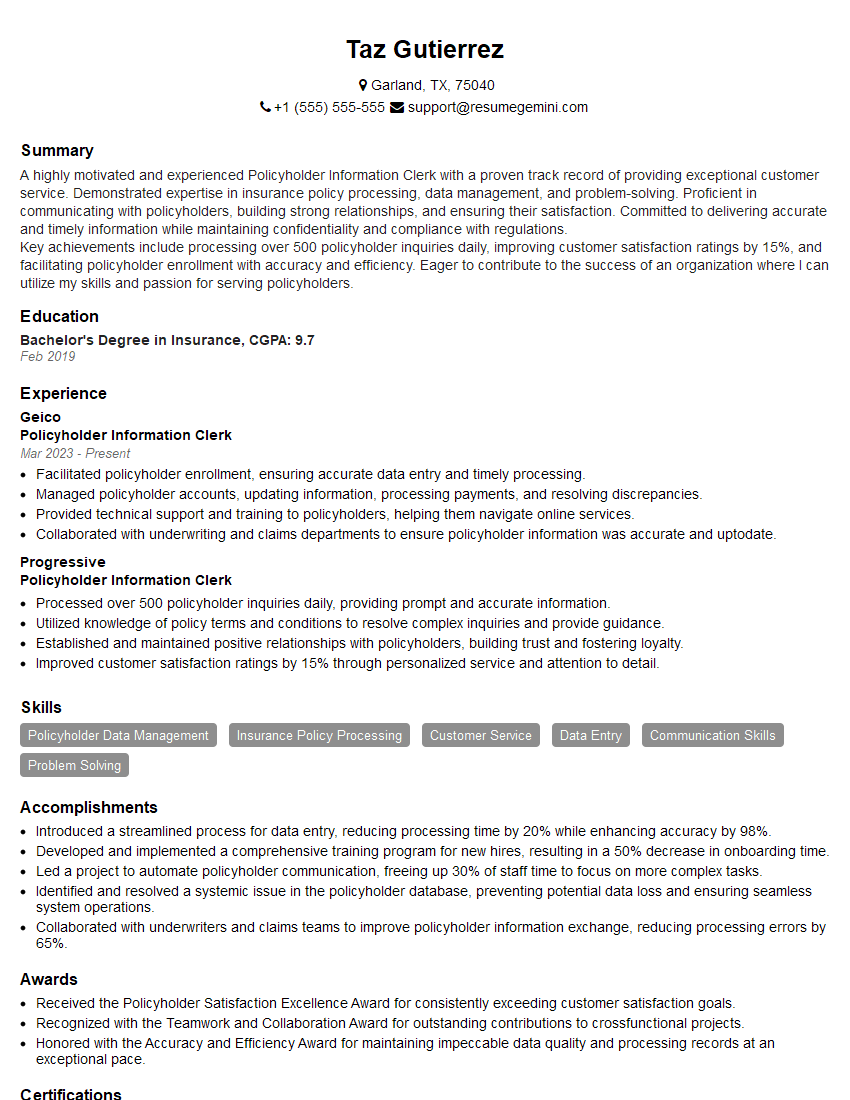

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Policyholder Information Clerk

1. What are the key responsibilities of a Policyholder Information Clerk?

The key responsibilities of a Policyholder Information Clerk include:

- Answering phone calls and emails from policyholders

- Providing information about policies, coverage, and claims

- Processing policy changes and requests

- Maintaining accurate policyholder records

- Resolving policyholder complaints

2. What are some of the challenges you have faced in your previous role as a Policyholder Information Clerk?

Some of the challenges I have faced in my previous role as a Policyholder Information Clerk include:

- Dealing with difficult customers

- Keeping up with changes in policy and coverage

- Processing large volumes of paperwork

- Meeting deadlines

- Working independently

3. What are some of your strengths as a Policyholder Information Clerk?

Some of my strengths as a Policyholder Information Clerk include:

- Excellent communication skills

- Strong knowledge of insurance policies and coverage

- Proven ability to process paperwork accurately and efficiently

- Ability to work independently and as part of a team

- Positive attitude and willingness to help others

4. What are some of your weaknesses as a Policyholder Information Clerk?

Some of my weaknesses as a Policyholder Information Clerk include:

- I can be somewhat impatient when dealing with difficult customers

- I am not always good at meeting deadlines

- I can be disorganized at times

- I am not always comfortable working independently

- I can be somewhat of a perfectionist

5. Why are you interested in working as a Policyholder Information Clerk for our company?

I am interested in working as a Policyholder Information Clerk for your company because I am passionate about helping people and I believe that my skills and experience would be a valuable asset to your team.

6. What are your salary expectations?

My salary expectations are commensurate with my skills and experience. I am confident that I can make a significant contribution to your company and I am willing to negotiate a salary that is fair to both parties.

7. What is your availability?

I am available to work full-time, part-time, or on a flexible schedule. I am also willing to work overtime if necessary.

8. Do you have any questions for me?

Yes, I do have a few questions for you:

- What is the company culture like?

- What are the opportunities for advancement?

- What is the company’s commitment to training and development?

9. Tell me about a time when you had to deal with a difficult customer. How did you handle the situation?

I recently had to deal with a difficult customer who was angry because his claim had been denied. I listened to his concerns and tried to understand his point of view. I then explained the company’s policy and why his claim had been denied. I was able to calm him down and he eventually understood the situation.

10. What is your experience with insurance software?

I have experience with a variety of insurance software programs, including [list of software programs]. I am proficient in using these programs to process policies, claims, and other insurance-related tasks.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Policyholder Information Clerk.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Policyholder Information Clerk‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Policyholder Information Clerks are responsible for maintaining and updating policyholder information, handling inquiries, and providing customer service.

1. Maintain and Update Policyholder Information

This includes updating addresses, phone numbers, email addresses, and other contact information. Clerks may also need to update policy coverage, payment information, and claims history.

- Process new policy applications and renewals

- Maintain accurate and up-to-date policyholder records

2. Handle Inquiries

Policyholder Information Clerks may handle inquiries from policyholders, agents, and other employees. They may need to answer questions about policy coverage, claims, and billing. Clerks may also need to resolve complaints and provide general assistance.

- Respond to phone calls, emails, and letters

- Provide information about policy coverage, claims, and billing

3. Provide Customer Service

Policyholder Information Clerks are responsible for providing excellent customer service. They must be patient, courteous, and helpful. Clerks may also need to go the extra mile to resolve issues and ensure that policyholders are satisfied.

- Resolve complaints and provide general assistance

- Maintain a positive attitude and build strong relationships with customers

4. Other Duties

Policyholder Information Clerks may also perform other duties, such as:

- Process policy changes

- Prepare correspondence

- File claims

Interview Tips

To help a candidate ace an interview, you can share these interview tips and preparation hacks:

1. Be Prepared to Answer Questions About Your Experience

The interviewer will likely ask you about your experience in the insurance industry. Be prepared to discuss your skills and knowledge in detail. You can share examples of times when you have successfully handled policyholder inquiries or resolved complaints.

- Example Outline:

- – Tell me about your experience in the insurance industry.

- – Can you describe a time when you successfully handled a difficult policyholder inquiry?

- – How would you resolve a complaint from a policyholder who is unhappy with their coverage?

2. Be Professional and Courteous

The interviewer will be evaluating your professionalism and courtesy throughout the interview. Be sure to dress appropriately, arrive on time, and maintain a positive attitude.

- Example Outline:

- – Make eye contact with the interviewer and smile.

- – Be polite and respectful, even if you are asked difficult questions.

- – Thank the interviewer for their time at the end of the interview.

3. Be Enthusiastic and Positive

The interviewer will be looking for candidates who are enthusiastic about the insurance industry and have a positive attitude. Be sure to convey your passion for the job and your desire to learn more about the company.

- Example Outline:

- – Share your reasons for wanting to work in the insurance industry.

- – Talk about your interest in the company and its products.

- – Express your excitement about the opportunity to learn and grow in the role.

4. Practice Your Answers

Before the interview, take some time to practice answering common interview questions. This will help you feel more confident and prepared during the actual interview.

- Example Outline:

- – Write down a list of potential interview questions.

- – Practice answering the questions out loud.

- – Get feedback from a friend or family member.

5. Ask Questions

At the end of the interview, be sure to ask the interviewer questions about the company and the position. This shows that you are interested in the job and that you have taken the time to prepare for the interview.

- Example Outline:

- – Can you tell me more about the company’s culture?

- – What are the biggest challenges facing the insurance industry today?

- – What are the opportunities for advancement within the company?

Next Step:

Now that you’re armed with the knowledge of Policyholder Information Clerk interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Policyholder Information Clerk positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini