Are you gearing up for a career in Retail Mortgage Processor? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Retail Mortgage Processor and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

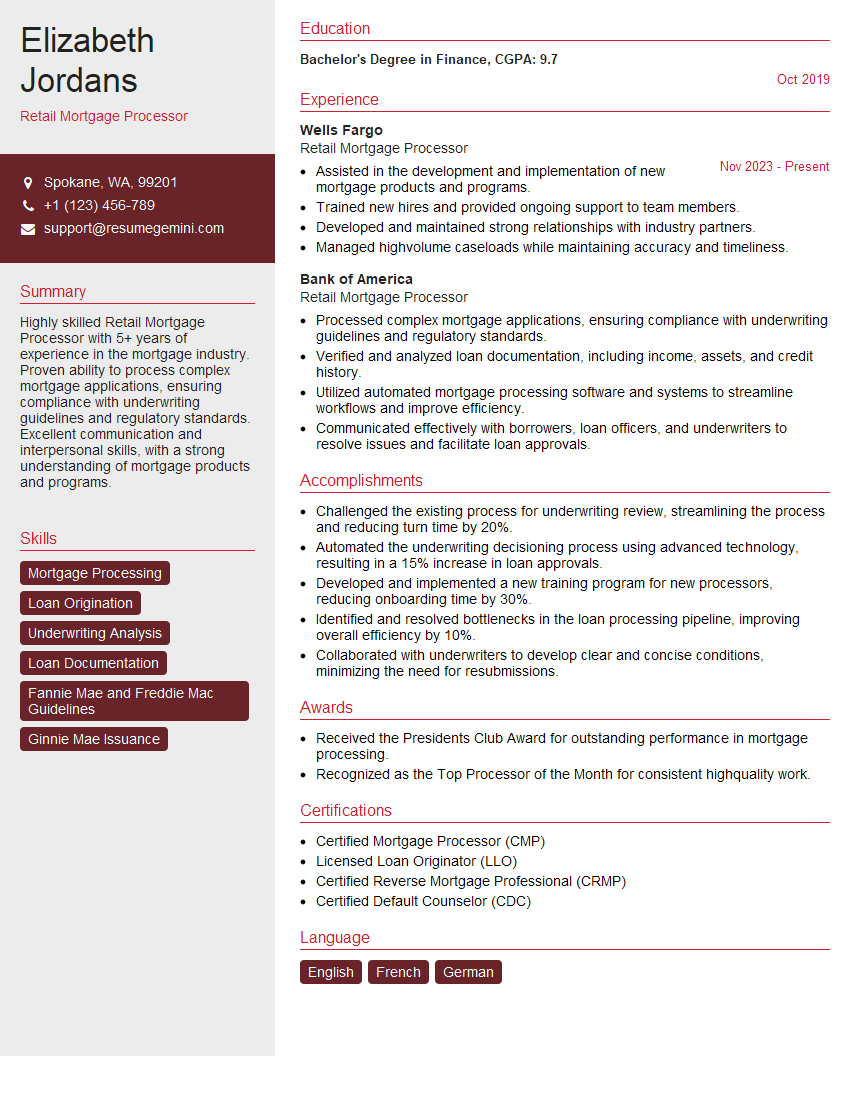

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Retail Mortgage Processor

1. What are the key steps involved in processing a mortgage application?

- Collecting and verifying loan application documents

- Performing credit analysis and risk assessment

- Ordering and reviewing appraisals, title reports, and flood certifications

- Preparing and submitting loan documents for underwriting approval

- Communicating with borrowers, lenders, and other parties throughout the process

2. Describe the different types of mortgage loans and their eligibility requirements.

FHA Loans

- Designed for first-time homebuyers and those with lower credit scores

- Require a lower down payment (3.5%)

- Backed by the Federal Housing Administration (FHA)

Conventional Loans

- Do not require mortgage insurance if the down payment is 20% or more

- Have higher credit score and income requirements

- Offer lower interest rates compared to FHA loans

VA Loans

- Available to active-duty military members, veterans, and their surviving spouses

- Do not require a down payment or mortgage insurance

- Have competitive interest rates

3. How do you handle discrepancies or missing information in mortgage applications?

- Contact the borrower to clarify the information

- Request additional documentation to support the missing information

- Work with the lender to determine if the discrepancies impact the loan approval

- Document all communication and actions taken

4. What is the importance of loan origination software (LOS) in mortgage processing?

- Automates many tasks, such as data entry, document generation, and communication

- Improves efficiency and reduces processing time

- Provides real-time visibility into the loan status

- Enhances compliance by ensuring adherence to regulations

5. How do you stay updated on changes in mortgage regulations and guidelines?

- Attend industry conferences and webinars

- Read trade publications and online resources

- Review updates from lenders and government agencies

- Participate in continuing education programs

6. What is the role of a mortgage broker in the mortgage process?

- Works with borrowers to determine loan options and secure financing

- Compares loan programs and interest rates from multiple lenders

- Assists with completing the loan application and gathering required documentation

- Serves as a liaison between borrowers and lenders

7. How do you prioritize multiple loan files and manage your workload effectively?

- Use a task management system to track loan progress

- Set deadlines and prioritize tasks based on urgency and impact

- Delegate tasks to team members when necessary

- Communicate with supervisors and team members to manage expectations

8. What are some common challenges you encounter in mortgage processing and how do you overcome them?

- Loan application errors: Communicate with borrowers and request missing or corrected documents

- Credit disputes: Work with borrowers to provide supporting documentation and resolve discrepancies

- Appraisal delays: Follow up with appraisers and manage expectations with borrowers

- Regulatory changes: Stay updated and communicate any changes that impact the processing timeline

9. What is your experience with using title insurance and flood insurance?

- Title insurance protects against claims made on the property ownership

- Flood insurance protects against financial losses due to flooding

- Familiarity with the types, coverage, and requirements of title and flood insurance

10. How do you maintain confidentiality and protect borrower information?

- Follow company policies and industry best practices

- Use secure storage and transmission methods for sensitive data

- Limit access to borrower information only to authorized personnel

- Shred or destroy confidential documents properly

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Retail Mortgage Processor.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Retail Mortgage Processor‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities of Retail Mortgage Processor

Retail Mortgage Processors play a pivotal role in facilitating the mortgage lending process, ensuring that loan applications are processed efficiently, accurately, and in compliance with regulatory standards.

1. Application Intake and Processing

The processor initiates the loan process by receiving and reviewing loan applications. They evaluate the applicant’s financial information, credit history, and property details, ensuring they meet the lender’s underwriting guidelines.

- Review loan applications for completeness and accuracy

- Verify applicant’s identity and income

- Obtain and review credit reports and property appraisals

2. Document Collection and Verification

The processor gathers and verifies all necessary documentation required for loan approval, including tax returns, pay stubs, and bank statements. They ensure the authenticity and reliability of these documents to mitigate fraud risk.

- Request and collect documentation from applicants

- Verify the authenticity and completeness of documents

- Maintain secure storage of sensitive information

3. Loan Preparation and Analysis

The processor prepares loan packages that include all pertinent financial information, property details, and supporting documentation. They analyze loan applications to assess the applicant’s creditworthiness and ability to repay the loan.

- Prepare loan summaries and disclosures

- Analyze loan applications for credit risks and compliance

- Recommend loan approvals or denials based on underwriting guidelines

4. Communication and Coordination

The processor serves as the primary point of contact for loan applicants, loan officers, and closing agents. They provide regular updates on the loan status, answer queries, and facilitate the smooth flow of information between parties.

- Communicate loan status to applicants and other stakeholders

- Resolve any issues or discrepancies that arise throughout the process

- Coordinate with closing agents to schedule and oversee loan closings

Interview Tips for Retail Mortgage Processor Roles

To ace an interview for a Retail Mortgage Processor position, candidates should prepare thoroughly and demonstrate a deep understanding of the role’s responsibilities, industry knowledge, and customer service skills.

1. Research the Company and Position

Before the interview, take the time to research the company’s background, loan products, and current market position. Understand the specific requirements of the role and how your skills and experience align with them.

- Visit the company’s website to learn about their history, mission, and services.

- Review the job description carefully to identify the key responsibilities and qualifications.

2. Highlight Relevant Experience and Skills

Emphasize your prior experience in mortgage processing or related financial roles. Quantify your accomplishments using specific metrics and examples to demonstrate your ability to handle complex tasks efficiently and accurately.

- Describe your responsibilities for processing mortgage applications, including document collection and verification.

- Provide examples of how you have ensured compliance with industry regulations and mitigated fraud risks.

3. Showcase Attention to Detail and Accuracy

Mortgage processing requires a meticulous approach and a keen eye for detail. Highlight your ability to review loan applications and supporting documentation for accuracy and completeness.

- Discuss your experience in identifying errors or inconsistencies in financial documents.

- Explain how you ensure that all loan packages are compliant with underwriting guidelines before submitting them for approval.

4. Demonstrate Customer Service Orientation

Mortgage processors often interact with applicants and other stakeholders throughout the loan process. Exhibit your excellent communication and interpersonal skills, and emphasize your commitment to providing exceptional customer service.

- Describe your experience in handling customer inquiries and resolving issues promptly.

- Share examples of how you have gone above and beyond to assist applicants with their mortgage needs.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Retail Mortgage Processor interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.