Are you gearing up for a career in Treasurer? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Treasurer and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

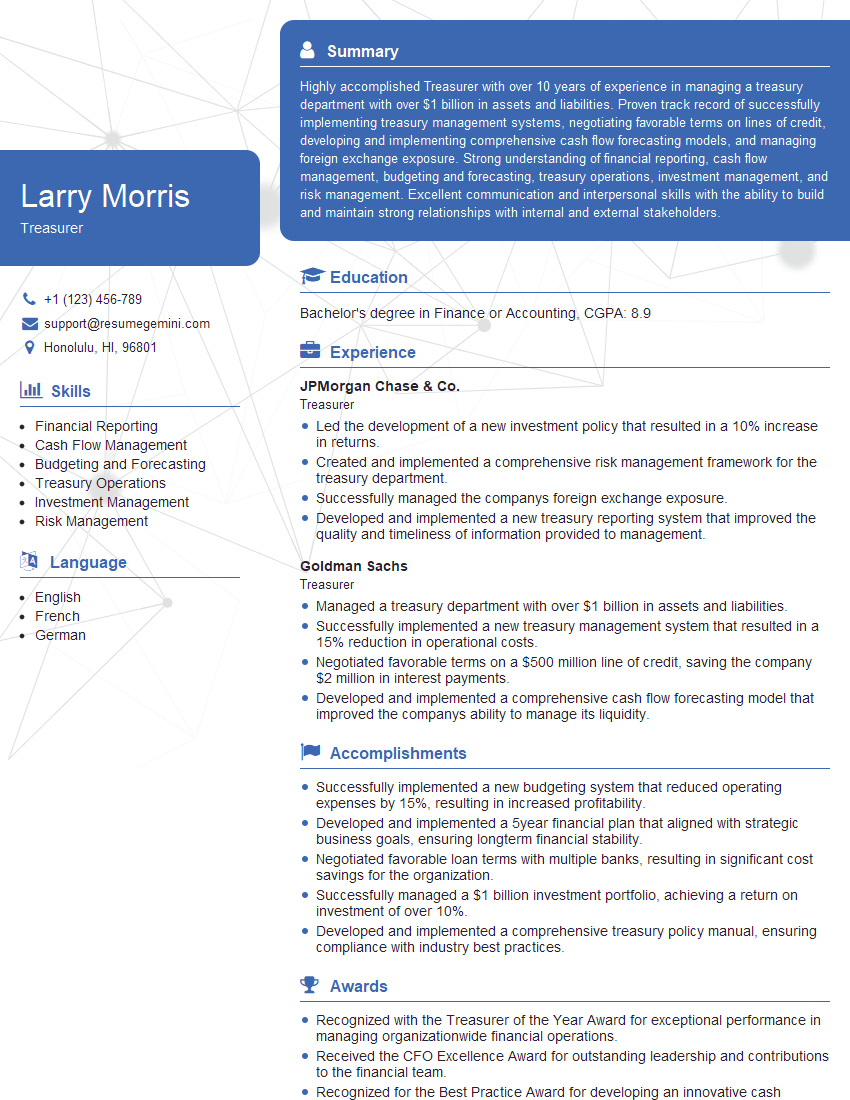

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Treasurer

1. Explain the key responsibilities of a Treasurer?

- Oversee the management of the organization’s financial resources

- Develop and implement financial strategies and policies

- Manage cash flow, investments, and banking relationships

- Prepare financial statements and reports for internal and external stakeholders

- Work closely with the CEO and other senior management to make financial decisions

2. Describe your experience in financial planning and analysis?

Budgeting and Forecasting

- Developed and maintained annual operating budgets

- Forecasted financial results using various analytical techniques

- Monitored actual performance against budget and made necessary adjustments

Investment Analysis

- Evaluated and recommended investment opportunities

- Monitored portfolio performance and made adjustments as needed

- Developed investment strategies to meet financial goals

3. How do you stay updated on the latest developments in financial regulations?

- Attend industry conferences and webinars

- Read trade publications and news articles

- Participate in professional organizations

- Seek guidance from legal counsel and other experts

4. What are your strengths and weaknesses as a Treasurer?

- Strong financial acumen and analytical skills

- Proven track record of success in treasury management

- Excellent written and verbal communication skills

- Ability to work independently and as part of a team

- Limited experience in international treasury operations

- I am constantly seeking opportunities to expand my knowledge and skills

Strengths

Weaknesses

5. How do you prioritize your tasks and manage your time effectively?

- Use a task management system to track my tasks and deadlines

- Prioritize tasks based on urgency and importance

- Delegate tasks to others when possible

- Take breaks and make time for self-care to maintain productivity

6. How do you handle stress and pressure in a high-stakes environment?

- Stay calm and focused under pressure

- Break down large tasks into smaller, manageable steps

- Seek support from colleagues and supervisors when needed

- Take breaks and engage in stress-reducing activities

7. What are your thoughts on the role of technology in treasury management?

- Technology can streamline and automate many treasury tasks

- It can provide real-time visibility into financial data

- It can help treasurers make more informed decisions

- However, it is important to implement and use technology effectively to avoid risks

8. What is your experience in managing cash flow?

- Developed and implemented cash flow management strategies

- Forecasted cash flow requirements and managed liquidity

- Negotiated with banks and other financial institutions to obtain financing

- Monitored cash flow on a daily basis and made necessary adjustments

9. How do you handle financial risk?

- Identify and assess financial risks

- Develop and implement risk management strategies

- Monitor risks and make adjustments as needed

- Report on financial risks to senior management and the board of directors

10. What is your experience in external reporting?

- Prepared financial statements in accordance with GAAP and IFRS

- Filed financial reports with regulatory agencies

- Responded to inquiries from auditors and investors

- Presented financial information to senior management and the board of directors

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Treasurer.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Treasurer‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Treasurers play a pivotal role in the financial management of organizations. They are responsible for safeguarding assets, ensuring financial compliance, and providing strategic guidance on investment and risk management.

1. Financial Management

Treasurers oversee the organization’s cash flow, investments, and debt management. They develop and implement strategies to optimize the use of financial resources and ensure liquidity.

- Manage cash flow forecasting and budgeting

- Invest surplus funds to generate returns

- Manage debt issuance and refinancing

2. Financial Compliance

Treasurers ensure that the organization complies with all applicable financial laws and regulations. They also develop and implement internal controls to prevent fraud and misuse of assets.

- Prepare and file financial statements

- Manage audits and tax compliance

- Implement internal control systems

3. Investment Management

Treasurers are responsible for managing the organization’s investment portfolio. They develop and implement investment strategies that align with the organization’s risk tolerance and return objectives.

- Develop and implement investment policies

- Monitor and evaluate investment performance

- Manage relationships with investment managers

4. Risk Management

Treasurers oversee the organization’s exposure to financial risks, such as currency fluctuations, interest rate changes, and credit risk. They develop and implement strategies to mitigate these risks and protect the organization’s financial health.

- Identify and assess financial risks

- Develop and implement risk management strategies

- Monitor and report on risk exposures

Interview Tips

Preparing thoroughly for a Treasurer interview is crucial to showcasing your skills and experience. Here are some tips to help you ace the interview:

1. Research the Organization

Familiarize yourself with the organization’s financial performance, industry, and strategic goals. This will help you demonstrate your understanding of the role and how your skills align with the organization’s needs.

2. Practice Common Interview Questions

Anticipate common interview questions and prepare thoughtful answers that highlight your relevant experience and knowledge. Practice answering these questions confidently and concisely.

3. Bring Examples of Your Work

Provide specific examples of your financial management, compliance, investment, and risk management experience. Quantify your accomplishments whenever possible to demonstrate your impact on the organization.

4. Highlight Your Technical Skills

Treasurers need a strong foundation in accounting, finance, and financial modeling. Emphasize your expertise in these areas and provide examples of how you have applied them successfully.

5. Show Your Understanding of Regulations

Demonstrate your knowledge of financial reporting standards, tax laws, and other regulations that impact the Treasurer role. This will show the interviewer that you are aware of the legal and ethical responsibilities of the position.

6. Be Prepared to Discuss Your Leadership Style

Treasurers often have leadership responsibilities within the finance team. Highlight your ability to manage and motivate teams, delegate effectively, and foster a positive work environment.

7. Ask Insightful Questions

At the end of the interview, ask thoughtful questions that demonstrate your interest in the organization and the role. This shows that you are engaged and eager to learn more about the position.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Treasurer interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.