Are you gearing up for a career in Underwriter Solicitation Director? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Underwriter Solicitation Director and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

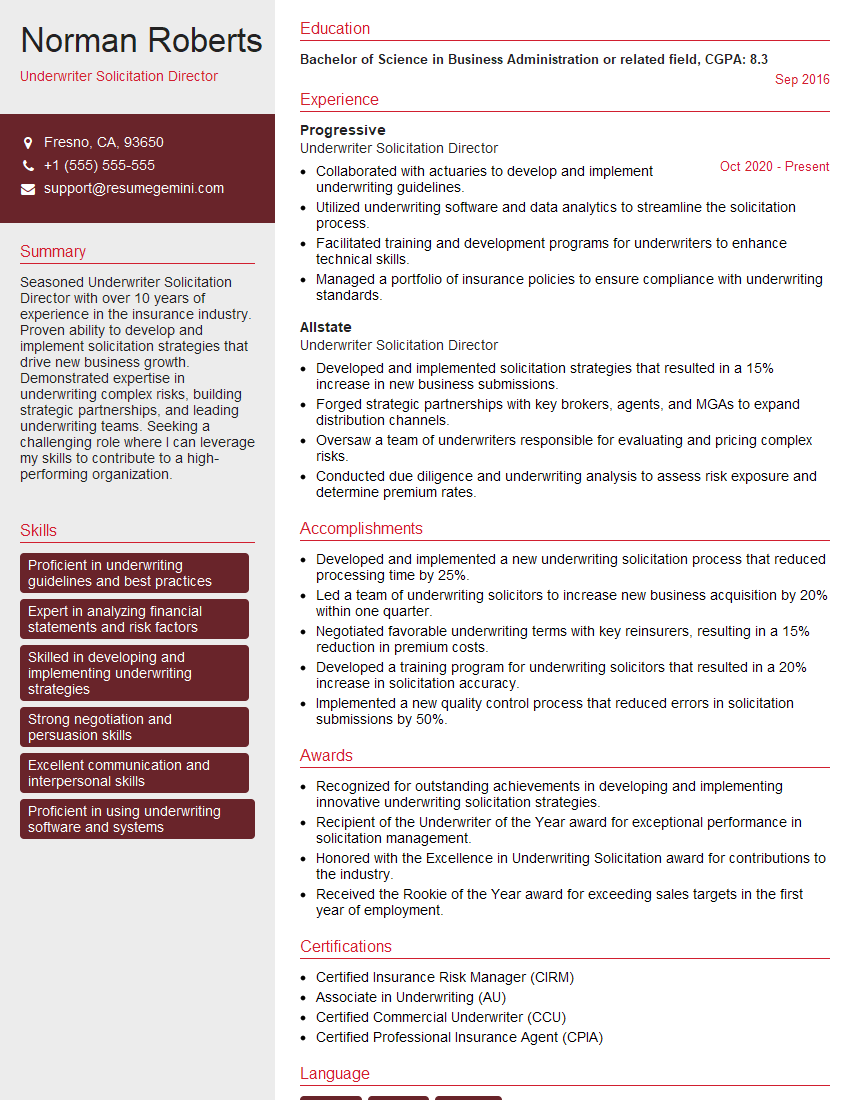

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Underwriter Solicitation Director

1. What are the key responsibilities of an Underwriter Solicitation Director?

As an Underwriter Solicitation Director, my primary responsibilities include:

- Developing and implementing solicitation strategies to attract and secure new underwriting business.

- Managing a team of underwriters and support staff to execute underwriting processes efficiently.

- Collaborating with sales and marketing teams to identify prospective clients and develop customized solutions.

2. How do you stay up-to-date on industry best practices and regulatory changes?

Attending Industry Events

- Participating in conferences, workshops, and seminars to connect with industry experts and learn about emerging trends.

Continuing Education

- Enrolling in relevant courses, certifications, and online learning platforms to expand knowledge and enhance skills.

Research and Analysis

- Regularly reviewing industry publications, regulatory updates, and whitepapers to gain insights into best practices and latest developments.

3. How do you assess the risk appetite of a potential client?

I conduct a comprehensive evaluation of a potential client’s risk profile by considering the following factors:

- Financial statements and credit history to assess financial stability and solvency.

- Industry analysis and market trends to understand the client’s competitive landscape and potential risks.

- Claims history and loss experience to gauge the likelihood and severity of potential claims.

- Management team and operational practices to assess the client’s ability to manage risks effectively.

4. How do you negotiate and structure underwriting contracts?

My approach to negotiating and structuring underwriting contracts involves the following steps:

- Thoroughly reviewing the client’s needs and risk profile to determine appropriate coverage terms and conditions.

- Collaborating with legal counsel to ensure compliance with regulatory requirements and industry standards.

- Negotiating premiums, deductibles, and policy limits to meet both the client’s budget and risk tolerance.

- Documenting the agreed-upon terms clearly and concisely in the underwriting contract.

5. How do you manage a team of underwriters?

As a leader, I believe in empowering my team and fostering a collaborative work environment. My approach to team management includes:

- Establishing clear expectations, goals, and performance metrics for each team member.

- Providing regular feedback, coaching, and development opportunities to enhance skills and knowledge.

- Encouraging teamwork and open communication to promote a positive and productive work atmosphere.

6. How do you prioritize and allocate resources effectively?

Prioritizing and allocating resources effectively is crucial to achieve optimal results. I employ the following strategies:

- Conducting a thorough analysis of available resources and potential investment opportunities.

- Evaluating projects based on their potential return on investment, risk profile, and alignment with strategic objectives.

- Communicating resource allocation decisions clearly to stakeholders and ensuring alignment with the overall business plan.

7. How do you stay organized and manage multiple projects simultaneously?

Staying organized and managing multiple projects simultaneously is essential to achieve productivity. I utilize the following techniques:

- Using project management software to track tasks, deadlines, and resource allocation.

- Prioritizing tasks based on urgency, importance, and dependencies.

- Delegating responsibilities effectively to team members to ensure timely execution.

8. How do you assess the financial health of a company?

Assessing the financial health of a company requires a comprehensive analysis of various financial metrics. I consider the following:

- Balance sheet: Analyzing assets, liabilities, and equity to evaluate the company’s financial position.

- Income statement: Reviewing revenue, expenses, and profitability to understand the company’s financial performance.

- Cash flow statement: Examining cash inflows and outflows to assess the company’s liquidity and solvency.

9. How do you communicate complex financial information to non-financial stakeholders?

Communicating complex financial information to non-financial stakeholders requires effective communication skills and the ability to simplify complex concepts. I employ the following strategies:

- Using clear and concise language to convey key financial messages.

- Providing visual aids, such as graphs and charts, to illustrate complex data.

- Tailoring the communication to the audience’s level of financial knowledge and interest.

10. How do you stay up-to-date on the latest developments in the financial industry?

Keeping up-to-date on the latest developments in the financial industry is crucial for staying competitive. I utilize the following resources:

- Subscribing to industry publications and financial news websites.

- Attending conferences and webinars to gain insights from industry experts.

- Networking with professionals in the financial services sector to exchange knowledge and ideas.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Underwriter Solicitation Director.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Underwriter Solicitation Director‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

The Underwriter Solicitation Director is responsible for leading and managing a team of underwriters in the solicitation and marketing of insurance products to new and existing clients. The ideal candidate will have a strong understanding of the insurance industry, as well as experience in sales and marketing. Key responsibilities include:

1. Develop and implement solicitation strategies

The Underwriter Solicitation Director is responsible for developing and implementing solicitation strategies to identify and target potential clients. This includes conducting market research, identifying industry trends, and developing marketing materials.

- Conduct market research to identify potential clients.

- Identify industry trends and develop marketing materials.

- Develop and implement solicitation strategies.

2. Manage a team of underwriters

The Underwriter Solicitation Director is responsible for managing a team of underwriters. This includes setting performance goals, providing training and development, and evaluating performance. The Director must also ensure that the team is working together effectively to achieve the company’s goals.

- Set performance goals for the underwriting team.

- Provide training and development for the underwriting team.

- Evaluate the performance of the underwriting team.

- Ensure that the underwriting team is working together effectively.

3. Underwrite insurance policies

The Underwriter Solicitation Director is also responsible for underwriting insurance policies. This includes evaluating risks, setting premiums, and issuing policies. The Director must have a strong understanding of underwriting principles and practices.

- Evaluate risks and set premiums.

- Issue insurance policies.

- Maintain a portfolio of insurance policies.

4. Maintain relationships with clients

The Underwriter Solicitation Director is responsible for maintaining relationships with clients. This includes meeting with clients, providing advice, and resolving any issues. The Director must be able to build and maintain strong relationships with clients.

- Meet with clients to discuss their insurance needs.

- Provide advice to clients on insurance products.

- Resolve any issues that clients may have.

- Maintain a database of client information.

Interview Tips

Preparing for an interview for the position of Underwriter Solicitation Director requires a thorough understanding of the role and the insurance industry. Here are some tips to help you ace your interview:

1. Research the company and the position

Before you go on an interview, it is important to research the company and the position you are applying for. This will help you understand the company’s culture, values, and goals. It will also help you understand the specific responsibilities of the Underwriter Solicitation Director position.

- Visit the company’s website to learn about its history, products, and services.

- Read the job description carefully to understand the specific responsibilities of the position.

- Talk to people who work at the company to get their insights into the culture and work environment.

2. Practice your answers to common interview questions

There are a number of common interview questions that you are likely to be asked, such as “Tell me about yourself” and “Why are you interested in this position?”. It is important to practice your answers to these questions so that you can deliver them confidently and concisely.

- Brainstorm a list of common interview questions.

- Write out your answers to these questions.

- Practice your answers out loud until you feel confident and comfortable.

3. Be prepared to talk about your experience

The interviewer will likely ask you about your experience in the insurance industry. Be prepared to talk about your experience in underwriting, sales, and marketing. Highlight your accomplishments and the skills that you have developed.

- Prepare a list of your accomplishments in the insurance industry.

- Be able to talk about your experience in underwriting, sales, and marketing.

- Highlight the skills that you have developed in the insurance industry.

4. Be prepared to ask questions

At the end of the interview, the interviewer will likely ask you if you have any questions. This is your opportunity to learn more about the company and the position. It is also a good way to show the interviewer that you are interested in the position and that you have done your research.

- Prepare a list of questions to ask the interviewer.

- These questions should be about the company, the position, and the work environment.

- Asking questions shows the interviewer that you are interested in the position and that you have done your research.

Next Step:

Now that you’re armed with the knowledge of Underwriter Solicitation Director interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Underwriter Solicitation Director positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini