Are you a seasoned Liquidator seeking a new career path? Discover our professionally built Liquidator Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

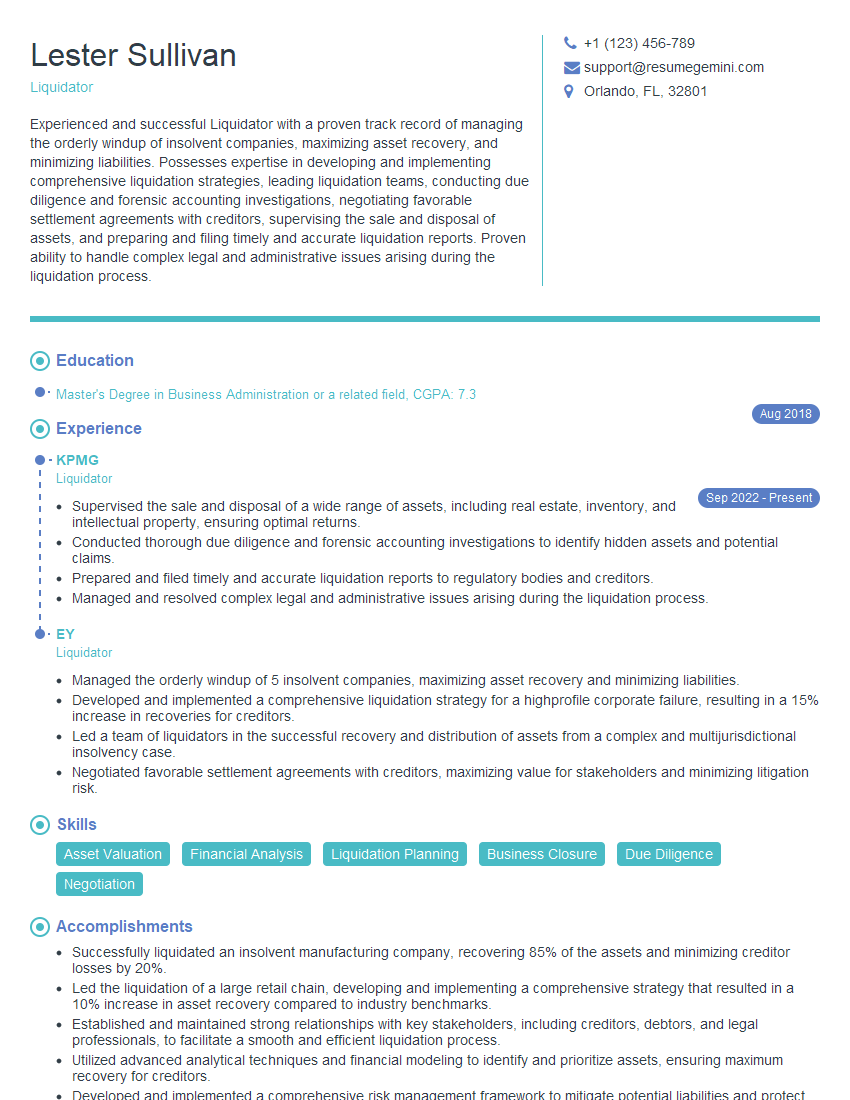

Lester Sullivan

Liquidator

Summary

Experienced and successful Liquidator with a proven track record of managing the orderly windup of insolvent companies, maximizing asset recovery, and minimizing liabilities. Possesses expertise in developing and implementing comprehensive liquidation strategies, leading liquidation teams, conducting due diligence and forensic accounting investigations, negotiating favorable settlement agreements with creditors, supervising the sale and disposal of assets, and preparing and filing timely and accurate liquidation reports. Proven ability to handle complex legal and administrative issues arising during the liquidation process.

Education

Master’s Degree in Business Administration or a related field

August 2018

Skills

- Asset Valuation

- Financial Analysis

- Liquidation Planning

- Business Closure

- Due Diligence

- Negotiation

Work Experience

Liquidator

- Supervised the sale and disposal of a wide range of assets, including real estate, inventory, and intellectual property, ensuring optimal returns.

- Conducted thorough due diligence and forensic accounting investigations to identify hidden assets and potential claims.

- Prepared and filed timely and accurate liquidation reports to regulatory bodies and creditors.

- Managed and resolved complex legal and administrative issues arising during the liquidation process.

Liquidator

- Managed the orderly windup of 5 insolvent companies, maximizing asset recovery and minimizing liabilities.

- Developed and implemented a comprehensive liquidation strategy for a highprofile corporate failure, resulting in a 15% increase in recoveries for creditors.

- Led a team of liquidators in the successful recovery and distribution of assets from a complex and multijurisdictional insolvency case.

- Negotiated favorable settlement agreements with creditors, maximizing value for stakeholders and minimizing litigation risk.

Accomplishments

- Successfully liquidated an insolvent manufacturing company, recovering 85% of the assets and minimizing creditor losses by 20%.

- Led the liquidation of a large retail chain, developing and implementing a comprehensive strategy that resulted in a 10% increase in asset recovery compared to industry benchmarks.

- Established and maintained strong relationships with key stakeholders, including creditors, debtors, and legal professionals, to facilitate a smooth and efficient liquidation process.

- Utilized advanced analytical techniques and financial modeling to identify and prioritize assets, ensuring maximum recovery for creditors.

- Developed and implemented a comprehensive risk management framework to mitigate potential liabilities and protect the interests of all parties involved.

Awards

- Received the Liquidator of the Year Award for outstanding performance in maximizing asset recovery and minimizing liabilities.

- Honored with the Distinction for Excellence in Liquidation Management, recognizing the ability to navigate complex legal and financial challenges.

- Awarded the Liquidation Excellence Award for exceptional proficiency in winding down distressed businesses and preserving value for stakeholders.

Certificates

- Certified Insolvency and Restructuring Advisor (CIRA)

- Certified Valuation Analyst (CVA)

- Certified Turnaround Professional (CTP)

- Certified Bankruptcy Specialist (CBS)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Liquidator

- Highlight your experience managing complex and high-profile liquidations, emphasizing the value you delivered to creditors and stakeholders.

- Quantify your accomplishments whenever possible, using metrics such as recovery rates, increases in creditor returns, and reductions in liabilities.

- Showcase your expertise in various aspects of liquidation, including asset valuation, financial analysis, due diligence, and negotiation.

- Demonstrate your ability to handle legal and administrative challenges effectively, ensuring a smooth and efficient liquidation process.

- Include keywords such as ‘liquidation planning’, ‘business closure’, ‘due diligence’, and ‘asset recovery’ throughout your resume to enhance visibility.

Essential Experience Highlights for a Strong Liquidator Resume

- Oversee the orderly winding-up of insolvent companies, ensuring compliance with all relevant laws and regulations.

- Develop and execute comprehensive liquidation strategies to maximize recoveries for creditors and stakeholders.

- Lead teams of liquidators in the identification, valuation, and recovery of assets, including real estate, inventory, and intellectual property.

- Negotiate favorable settlement agreements with creditors to minimize litigation risk and maximize value for all parties involved.

- Supervise the sale and disposal of assets through various methods, including auctions, private sales, and liquidations.

- Conduct thorough due diligence and forensic accounting investigations to identify hidden assets, potential claims, and liabilities.

- Prepare and file timely and accurate liquidation reports to regulatory bodies and creditors, ensuring transparency and accountability.

Frequently Asked Questions (FAQ’s) For Liquidator

What are the key skills required to be a successful liquidator?

Successful liquidators typically possess a combination of hard and soft skills, including financial analysis, asset valuation, liquidation planning, business closure, due diligence, negotiation, communication, and project management.

What is the role of a liquidator in an insolvency proceeding?

In an insolvency proceeding, the liquidator is appointed to take control of the insolvent company’s assets, investigate its financial affairs, and distribute the proceeds to creditors in accordance with the relevant laws and regulations.

What are the different methods used by liquidators to dispose of assets?

Liquidators may employ various methods to dispose of assets, including public auctions, private sales, liquidations, and negotiated sales. The choice of method depends on factors such as the nature of the assets, market conditions, and the need to maximize returns for creditors.

How do liquidators handle complex legal and administrative challenges during the liquidation process?

Liquidators often encounter complex legal and administrative challenges during the liquidation process. They must have a deep understanding of insolvency laws and regulations, as well as strong negotiation and problem-solving skills to navigate these challenges effectively and protect the interests of all stakeholders.

What are the ethical considerations that liquidators must be aware of?

Liquidators must adhere to strict ethical guidelines to ensure transparency, fairness, and accountability throughout the liquidation process. They must avoid conflicts of interest, maintain confidentiality, and act in the best interests of creditors and other stakeholders.

What is the role of creditors in the liquidation process?

Creditors play a crucial role in the liquidation process. They have the right to be informed about the progress of the liquidation, participate in creditor meetings, and vote on key decisions that affect their interests. Liquidators must communicate regularly with creditors and provide them with timely updates on the status of the liquidation.