Are you gearing up for a career in Credit Rating Inspector? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Credit Rating Inspector and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

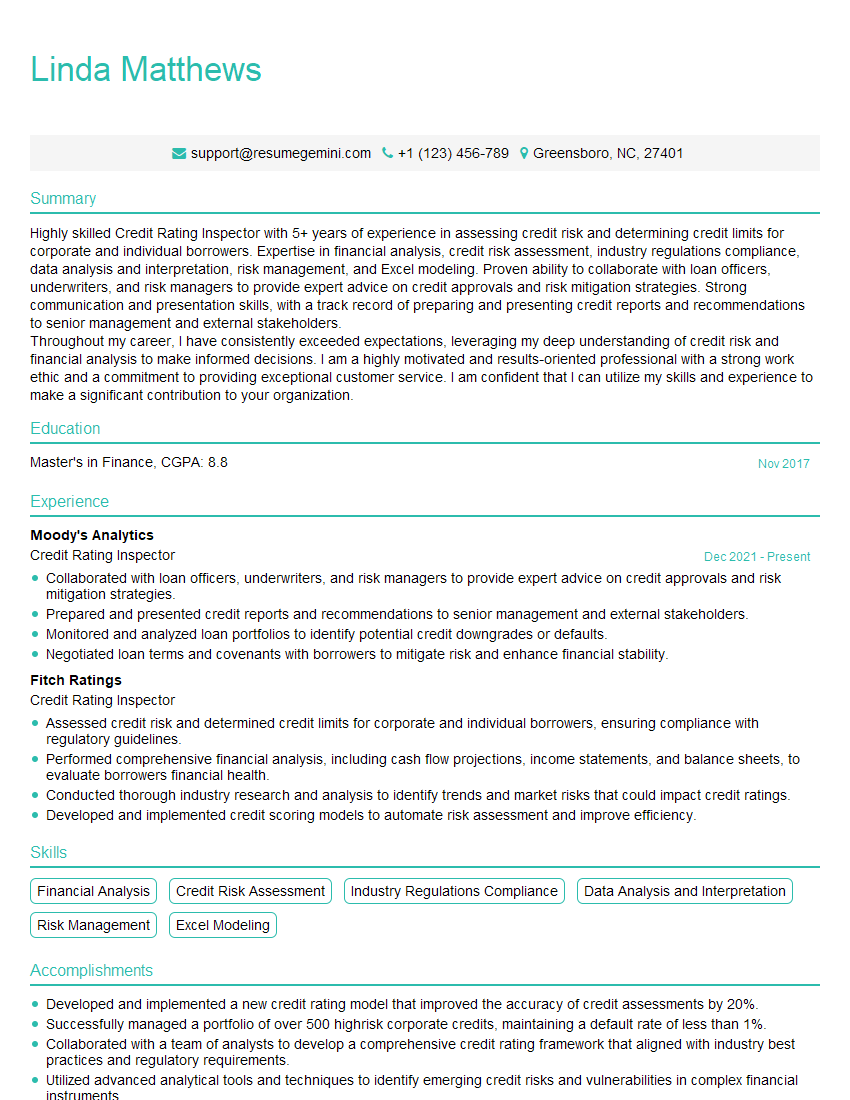

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Credit Rating Inspector

1. Explain the key analytical tools used in credit rating analysis?

The key analytical tools used in credit rating analysis include:

- Financial ratios: These are used to measure a company’s financial health and performance. Common financial ratios include the debt-to-equity ratio, the interest coverage ratio, and the profit margin.

- Cash flow analysis: This is used to assess a company’s ability to generate cash and meet its financial obligations. Cash flow analysis can be used to identify potential liquidity problems.

- Industry analysis: This is used to understand the competitive landscape and the key drivers of a company’s industry. Industry analysis can help to identify potential risks and opportunities.

- Management assessment: This is used to assess the quality of a company’s management team. Management assessment can help to identify potential risks or red flags.

2. How do you evaluate a company’s business model and competitive advantage?

subheading of the answer

- Business model evaluation: This involves assessing the company’s business strategy, revenue model, and cost structure. Business model evaluation can help to identify potential risks or opportunities.

- Competitive advantage evaluation: This involves assessing the company’s competitive advantages over its rivals. Competitive advantage evaluation can help to identify potential risks or opportunities.

subheading of the answer

- SWOT analysis: This is a useful tool for evaluating a company’s business model and competitive advantage. SWOT analysis involves identifying the company’s strengths, weaknesses, opportunities, and threats.

3. What are the different types of credit ratings and what do they mean?

The different types of credit ratings are:

- Investment grade: These ratings are assigned to companies that are considered to be low risk. Investment grade ratings typically range from AAA to BBB.

- Speculative grade: These ratings are assigned to companies that are considered to be higher risk. Speculative grade ratings typically range from BB+ to D.

- Default: A default rating is assigned to a company that has failed to make a scheduled debt payment. A default rating is the lowest possible rating.

4. How do you communicate your credit rating analysis and recommendations to clients?

I communicate my credit rating analysis and recommendations to clients in a clear and concise manner. I use a variety of communication methods, including written reports, presentations, and meetings. I tailor my communication to the specific needs of the client.

- Written reports: I write clear and concise reports that summarize my credit rating analysis and recommendations. I use visuals, such as charts and graphs, to help clients understand my findings.

- Presentations: I give presentations to clients that explain my credit rating analysis and recommendations. I use slides to summarize my findings and I answer questions from clients.

- Meetings: I meet with clients to discuss my credit rating analysis and recommendations. I use meetings to provide clients with more detailed information and to answer their questions.

5. What are the ethical considerations that you must take into account when conducting credit rating analysis?

The ethical considerations that I must take into account when conducting credit rating analysis include:

- Objectivity: I must be objective and impartial in my analysis. I must avoid allowing personal biases or conflicts of interest to influence my ratings.

- Accuracy: I must ensure that my analysis is accurate and based on sound judgment. I must use reliable data sources and verify my findings.

- Transparency: I must be transparent about my analysis and the factors that I have considered. I must avoid making misleading or unsubstantiated statements.

6. How do you stay up-to-date on the latest developments in the credit rating industry?

I stay up-to-date on the latest developments in the credit rating industry by reading industry publications, attending conferences, and networking with other professionals. I also take continuing education courses to enhance my knowledge and skills.

- Industry publications: I read industry publications, such as Credit Week and Moody’s Weekly Credit Outlook, to stay informed about the latest news and trends in the credit rating industry.

- Conferences: I attend industry conferences to learn about the latest developments in credit rating analysis and to network with other professionals.

- Continuing education courses: I take continuing education courses to enhance my knowledge and skills. I have recently taken courses on topics such as credit risk analysis and structured finance.

7. What are your strengths and weaknesses as a credit rating analyst?

subheading of the answer

- Strengths: My strengths as a credit rating analyst include my analytical skills, my attention to detail, and my ability to communicate my findings effectively.

- Weaknesses: My weaknesses as a credit rating analyst include my lack of experience in certain areas, such as structured finance. I am also working on improving my time management skills.

subheading of the answer

- How I am addressing my weaknesses: I am addressing my weaknesses by taking continuing education courses and by working on projects that will give me experience in the areas where I am lacking. I am also working on improving my time management skills by using a to-do list and by setting priorities.

8. Why are you interested in this position?

I am interested in this position because it is a great opportunity to use my skills and experience to make a meaningful contribution to your company. I am also excited about the opportunity to work with a team of experienced professionals and to learn from them.

- My skills and experience: I have the skills and experience that are necessary to be successful in this position. I have a strong understanding of credit rating analysis and I have a proven track record of success.

- Your company: I am impressed by your company’s reputation and I believe that my skills and experience would be a valuable asset to your team.

9. What are your salary expectations?

My salary expectations are in line with the market rate for similar positions. I am open to negotiating a salary that is fair and competitive.

- Market rate: I have researched the market rate for similar positions and I believe that my salary expectations are in line with the market rate.

- Negotiation: I am open to negotiating a salary that is fair and competitive. I am willing to consider a variety of factors, such as the company’s budget and the level of responsibility of the position.

10. When are you available to start?

I am available to start as soon as possible. I am flexible and can accommodate your schedule.

- Flexibility: I am flexible and can accommodate your schedule. I am willing to start work as soon as possible.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Credit Rating Inspector.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Credit Rating Inspector‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Credit Rating Inspectors assess the financial health of companies and governments to determine their creditworthiness. They play a crucial role in the financial industry, influencing investment decisions and risk management strategies.

1. Credit Analysis and Assessment

Analyze financial statements, market conditions, and economic indicators to assess the creditworthiness of borrowers.

- Evaluate the borrower’s financial performance, debt structure, and liquidity.

- Conduct industry, company, and management research.

2. Rating Issuance and Monitoring

Assign credit ratings to bonds, loans, and other debt instruments issued by companies and governments.

- Determine the level of risk associated with the borrower and the debt obligation.

- Monitor rated issuers and update ratings as needed based on changing conditions.

3. Research and Analysis

Keep abreast of economic and industry trends, as well as changes in regulatory and accounting practices.

- Conduct research to develop and refine credit rating methodologies.

- Attend industry conferences and seminars.

4. Client Management and Communication

Interact with issuers, investors, and other stakeholders to explain ratings and discuss credit analysis.

- Provide insights into market conditions and investment strategies.

- Participate in rating committee meetings and present findings.

Interview Tips

Preparing for an interview for a Credit Rating Inspector position requires a thorough understanding of the role and the industry. Here are some tips to help you ace the interview:

1. Research the Company and Industry

Before the interview, research the company and the credit rating industry as a whole. Understand the company’s history, key clients, and recent financial performance. Familiarize yourself with the industry’s best practices and regulatory requirements.

2. Highlight Your Analytical and Research Skills

Credit Rating Inspectors rely heavily on analytical and research skills. Showcase your ability to interpret financial data, identify trends, and draw meaningful conclusions. Provide examples of your experience in analyzing complex financial information and developing insightful reports.

3. Explain Your Understanding of Credit Rating Methodologies

Demonstrate your understanding of the methodologies used to assign credit ratings. Be prepared to discuss the factors considered in assessing creditworthiness and the different rating scales used by different agencies.

4. Practice Your Communication Skills

Credit Rating Inspectors need to be able to communicate their findings effectively to a variety of stakeholders. Practice your communication skills by preparing clear and concise presentations on financial analysis and credit ratings.

5. Use STAR Method

When answering interview questions, use the STAR method. Describe a specific situation (S), the task you were responsible for (T), the actions you took (A), and the results you achieved (R). This will help you provide structured and compelling answers.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Credit Rating Inspector interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.