Are you gearing up for a career in Credit Verifier? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Credit Verifier and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

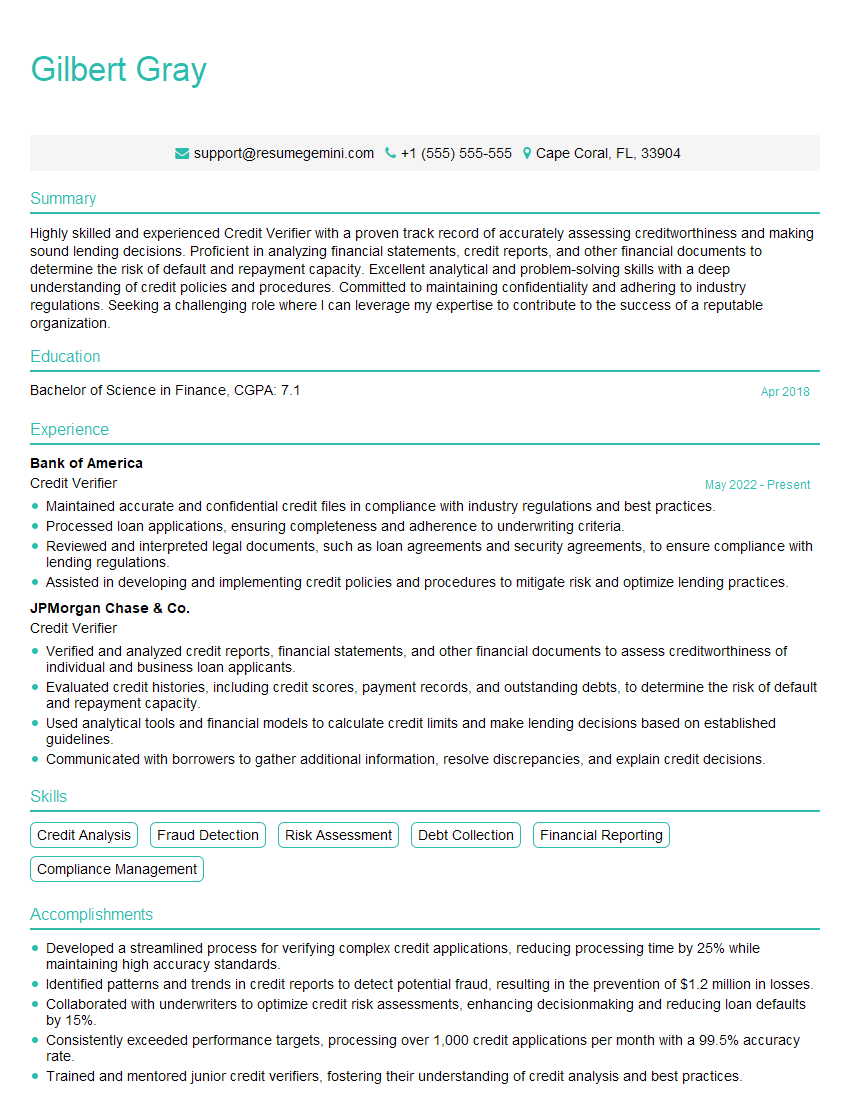

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Credit Verifier

1. How do you differ between a good and a bad credit report?

A good credit report indicates that the borrower has a history of making timely payments, managing debt responsibly, and has a low credit utilization ratio. On the other hand, a bad credit report shows a pattern of late payments, high credit utilization, collections, or bankruptcies.

2. How do you handle discrepancies in credit reports?

Verifying the Information

- Contact the credit bureau and the creditor to verify the disputed information.

- Request a copy of the original documentation to support the claim.

Resolving the Dispute

- If the information is incorrect, file a dispute with the credit bureau and provide evidence to support the claim.

- If the creditor admits the error, they will update the credit report.

- If the dispute remains unresolved, request an investigation by the credit bureau.

3. What are the key factors that affect a credit score?

- Payment history

- Amounts owed

- Length of credit history

- Credit mix

- New credit

4. Describe the process of verifying and validating credit information.

- Reviewing the credit report for accuracy and completeness

- Confirming the identity of the borrower

- Verifying the borrower’s income and employment information

- Checking for any outstanding judgments or liens

- Validating the borrower’s identity and financial information through third-party sources

5. How do you prioritize and manage a large number of credit verification requests?

- Establish clear priorities based on the urgency and importance of the requests

- Use a structured workflow system to track and manage the requests

- Delegate tasks and responsibilities to optimize efficiency

- Communicate effectively with stakeholders to ensure timely and accurate reporting

6. What are the most common red flags that you look for when reviewing credit reports?

- Late payments

- High credit utilization

- Collections and charge-offs

- Bankruptcies

- Inquiries from multiple creditors in a short period

7. Explain how you use technology to enhance your credit verification process.

- Using credit verification software to automate the process

- Accessing online databases to verify information quickly and efficiently

- Utilizing fraud detection tools to identify potential risks

8. How do you stay up-to-date on the latest credit regulations and industry best practices?

- Attending industry conferences and webinars

- Reading trade publications and research reports

- Participating in professional organizations

- Consulting with experts in the field

9. What is your approach to ensuring the confidentiality and security of sensitive credit information?

- Adhering to strict data protection protocols

- Using secure technology and encryption measures

- Limiting access to sensitive information to authorized personnel only

- Regularly reviewing and updating security measures

10. Can you provide an example of a complex or challenging credit verification scenario that you have successfully resolved?

Describe the situation, the challenges faced, and the steps taken to resolve the issue in detail, highlighting your problem-solving skills and ability to manage complex cases.

11. How do you handle situations where the borrower disputes the accuracy of the credit information?

- Review the disputed information and gather supporting documentation

- Contact the credit bureau and the creditor to investigate the matter

- Provide clear and concise explanations to the borrower

- Document the resolution of the dispute

12. Describe your understanding of different types of credit fraud and how you identify potential fraudulent activity.

- Identity theft

- Synthetic identity theft

- Account takeover fraud

- Application fraud

- Red flags to watch for, such as inconsistencies in information, unusual spending patterns, and suspicious inquiries

13. What are the ethical considerations in credit verification, and how do you maintain objectivity and fairness?

- Adhering to industry regulations and ethical guidelines

- Treating all borrowers fairly and without bias

- Respecting the confidentiality of sensitive information

- Avoiding conflicts of interest

14. How do you prioritize and manage a large number of credit verification requests?

- Establishing clear priorities based on the urgency and importance of the requests

- Using a structured workflow system to track and manage the requests

- Communicating effectively with stakeholders to ensure timely and accurate reporting

15. What is your experience in using credit scoring models and how do you interpret the results?

- Understanding different types of credit scoring models

- Interpreting credit scores and assessing risk

- Using credit scores in conjunction with other factors to make informed decisions

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Credit Verifier.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Credit Verifier‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Credit Verifiers are responsible for ensuring that the information provided by loan applicants is accurate and complete. Their primary duties involve:

1. Verifying Credit History

Analyzing credit reports to assess an applicant’s creditworthiness.

- Reviewing credit scores, payment histories, and outstanding debts.

- Contacting credit bureaus to verify the accuracy of credit information.

2. Documenting Findings

Preparing detailed reports that summarize the results of credit verifications.

- Recording all relevant information, including income, employment, and asset verification.

- Providing clear and concise explanations of any discrepancies or inconsistencies in the applicant’s credit history.

3. Assessing Risk

Using verified information to assess the risk associated with approving a loan application.

- Evaluating credit scores and payment histories to determine the likelihood of default.

- Analyzing income and employment stability to assess the applicant’s ability to repay the loan.

4. Compliance and Regulations

Adhering to all applicable laws and regulations governing credit verification processes.

- Ensuring compliance with the Fair Credit Reporting Act (FCRA) and other relevant regulations.

- Maintaining confidentiality of sensitive applicant information.

Interview Tips

To ace the Credit Verifier interview, it’s crucial to prepare thoroughly and showcase your understanding of the role and your skills. Here are some helpful tips:

1. Research the Company and Position

Familiarize yourself with the company’s background, industry, and specific role you’re applying for. Research the job description, key responsibilities, and any additional information that gives you a comprehensive understanding of the role.

- Example: You could visit the company’s website, read industry news, or connect with current or former employees on LinkedIn.

2. Practice Answering Common Interview Questions

Anticipate common interview questions and prepare thoughtful responses that highlight your relevant skills and experiences. Focus on demonstrating your knowledge of credit verification processes, your ability to assess risk, and your attention to detail.

- Example: Prepare to discuss your experience in verifying credit history, documenting findings, and evaluating risk in previous roles.

3. Emphasize Soft Skills

In addition to technical skills, interviewers value soft skills such as communication, interpersonal skills, and problem-solving abilities. Be prepared to provide examples of your ability to communicate effectively with clients and colleagues, resolve disputes, and handle confidential information.

- Example: Highlight your experience in dealing with customers, resolving inconsistencies in credit reports, or working as part of a team.

4. Ask Thoughtful Questions

Asking well-thought-out questions at the end of the interview demonstrates your interest in the position and the company. Prepare questions that show your understanding of the role, the company’s goals, or the industry in general.

- Example: You could ask about the company’s approach to risk management, the challenges facing the credit verification industry, or the potential for career growth within the organization.

Next Step:

Now that you’re armed with the knowledge of Credit Verifier interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Credit Verifier positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini