Feeling lost in a sea of interview questions? Landed that dream interview for Loan Clerk but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Loan Clerk interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

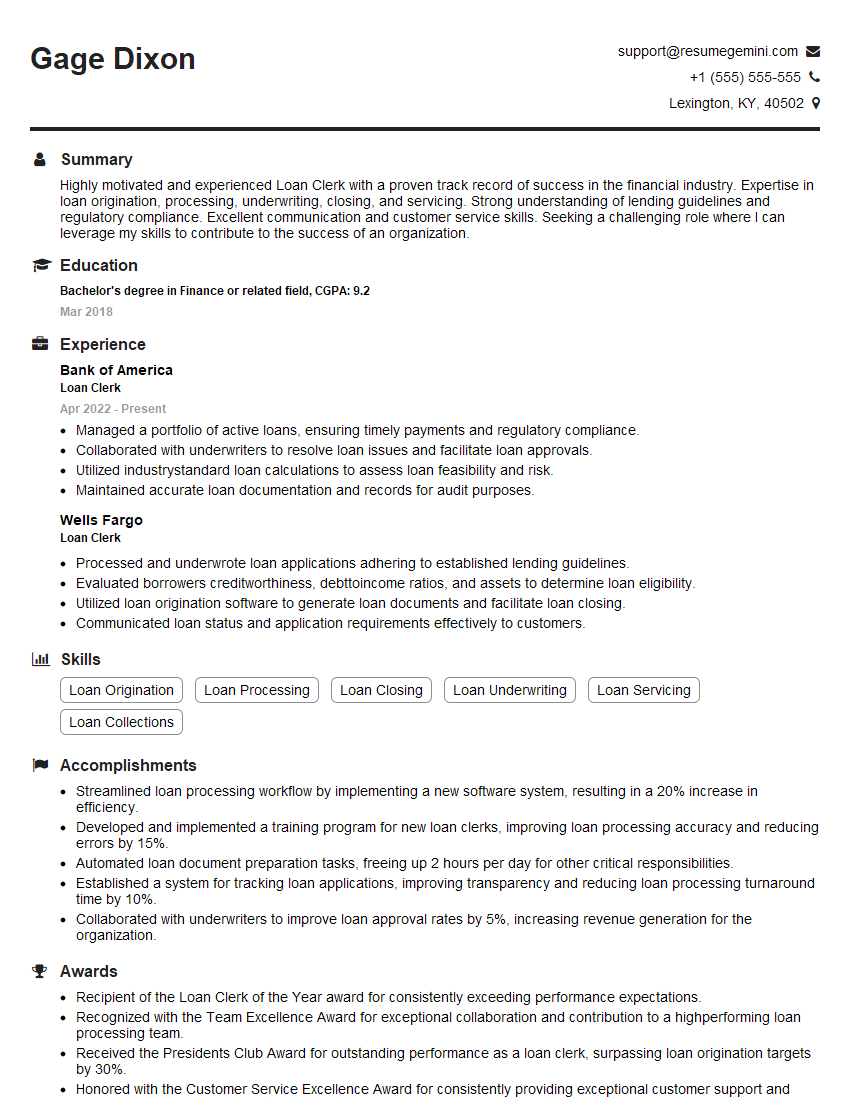

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Loan Clerk

1. Explain the key responsibilities of a Loan Clerk?

- Process loan applications, including verifying creditworthiness and collecting documentation.

- Calculate loan repayments and interest charges.

- Disburse loan funds and track loan payments.

- Maintain loan records and handle customer inquiries.

- Comply with bank policies and regulations governing loan processing.

2. Describe the steps involved in processing a loan application?

Loan application review:

- Verify customer identity and financial information.

- Assess creditworthiness based on credit score, debt-to-income ratio, and employment history.

- Review collateral documentation and ensure it meets bank requirements.

Loan approval:

- Determine loan amount and terms based on application review.

- Obtain loan approval from loan officer or management.

- Prepare loan documents and ensure they are signed by the customer.

Loan funding:

- Disburse loan funds to customer as per loan agreement.

- Set up loan repayment schedule and establish payment channels.

3. How do you calculate loan repayments and interest charges?

Loan repayments are calculated based on the loan amount, interest rate, and loan term. I use loan calculation formulas or software to determine the monthly payments and total interest charges. I ensure accuracy and compliance with bank policies and lending regulations.

4. What are the different types of loans you have experience processing?

I have experience processing various types of loans, including personal loans, mortgages, auto loans, and business loans. Each type of loan has its specific characteristics and requirements, and I am familiar with the documentation and procedures involved.

5. How do you stay up-to-date on changes in loan regulations and bank policies?

- Attend training sessions and workshops on regulatory updates.

- Subscribe to industry publications and newsletters.

- Review internal bank memos and policy updates regularly.

- Consult with senior loan officers and management for guidance.

6. What do you consider when evaluating a customer’s creditworthiness?

- Credit score and history.

- Debt-to-income ratio.

- Employment stability and income verification.

- Collateral value and type.

- Previous banking relationships and payment patterns.

7. How do you handle loan applications from customers with low credit scores or high debt-to-income ratios?

I assess each case individually and explore alternative options with the customer. I may request additional documentation or recommend credit counseling services. I collaborate with the loan officer to determine if there are any compensating factors that could support loan approval.

8. What is your process for handling customer inquiries and complaints?

- Listen attentively to the customer’s concerns.

- Review account details and loan documents to verify the issue.

- Provide clear and accurate explanations.

- Resolve the issue promptly or escalate it to the supervisor as needed.

- Maintain a positive and professional demeanor.

9. How do you manage a high volume of loan applications and ensure timely processing?

- Establish a streamlined workflow and prioritize applications based on urgency.

- Use technology tools and automation to enhance efficiency.

- Delegate tasks to support staff as needed.

- Communicate regularly with customers to keep them informed of the progress.

- Work overtime or extended hours during peak periods to meet deadlines.

10. What are some common challenges you face as a Loan Clerk and how do you overcome them?

- Incomplete or inaccurate applications: I request missing information from customers and guide them through the correction process.

- Complex loan structures: I consult with senior loan officers to understand the requirements and ensure proper documentation.

- Customer disputes: I investigate the issue thoroughly, provide clear explanations, and work towards a mutually acceptable resolution.

- High workload: I prioritize tasks, delegate effectively, and seek support from colleagues to ensure timely processing.

- Regulatory compliance: I stay up-to-date on regulations and consult with the compliance department to ensure adherence.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Loan Clerk.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Loan Clerk‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Loan Clerk is responsible for various tasks related to the processing and management of loans. These responsibilities may vary depending on the size and type of financial institution, but some of the most common include:

1. Loan Processing

Receiving loan applications from customers.

- Verifying the completeness and accuracy of the applications.

- Collecting and reviewing supporting documentation.

- Conducting credit checks and other due diligence.

- Preparing loan documents for approval.

2. Loan Closing

Scheduling and attending loan closings.

- Explaining loan details to borrowers and obtaining signatures.

- Disbursing loan proceeds.

- Recording and filing loan documents.

3. Loan Servicing

Maintaining loan records.

- Processing loan payments.

- Responding to customer inquiries and requests.

- Monitoring loan performance and identifying potential problems.

4. Customer Service

Providing excellent customer service to loan applicants and borrowers.

- Answering questions and resolving issues.

- Maintaining confidentiality and ensuring compliance with regulations and policies.

Interview Tips

Preparing for a Loan Clerk interview can help you make a strong impression and increase your chances of getting the job. Here are some tips to help you ace your interview:

1. Research the company and position

Take some time to learn about the financial institution and the specific loan clerk position. This will help you understand the company’s culture and the responsibilities of the role.

- Visit the company’s website and social media pages.

- Read industry news and articles.

- Talk to people in your network who work in the financial industry.

2. Practice your answers to common interview questions

There are a number of common interview questions that you are likely to be asked, such as “Tell me about yourself” and “Why are you interested in this position?”. It is helpful to practice your answers to these questions in advance so that you can deliver them confidently and concisely.

- Use the STAR method to answer behavioral interview questions.

- Highlight your skills and experience that are most relevant to the job.

- Be prepared to talk about your strengths and weaknesses.

3. Dress professionally and arrive on time

First impressions matter, so it is important to dress professionally and arrive on time for your interview. This shows that you are respectful of the interviewer’s time and that you take the interview seriously.

- Choose clothing that is clean, pressed, and appropriate for a business setting.

- Arrive at the interview location 5-10 minutes early.

- Be polite and respectful to everyone you meet, including the receptionist and other employees.

4. Be confident and enthusiastic

Confidence and enthusiasm are contagious, so make sure to project these qualities during your interview. This will help you make a positive impression on the interviewer and show that you are excited about the opportunity.

- Make eye contact with the interviewer and speak clearly and confidently.

- Be positive and enthusiastic about your skills and experience.

- Ask questions about the company and the position to show that you are engaged and interested.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Loan Clerk interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!