Are you gearing up for a career in Loan Closer? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Loan Closer and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

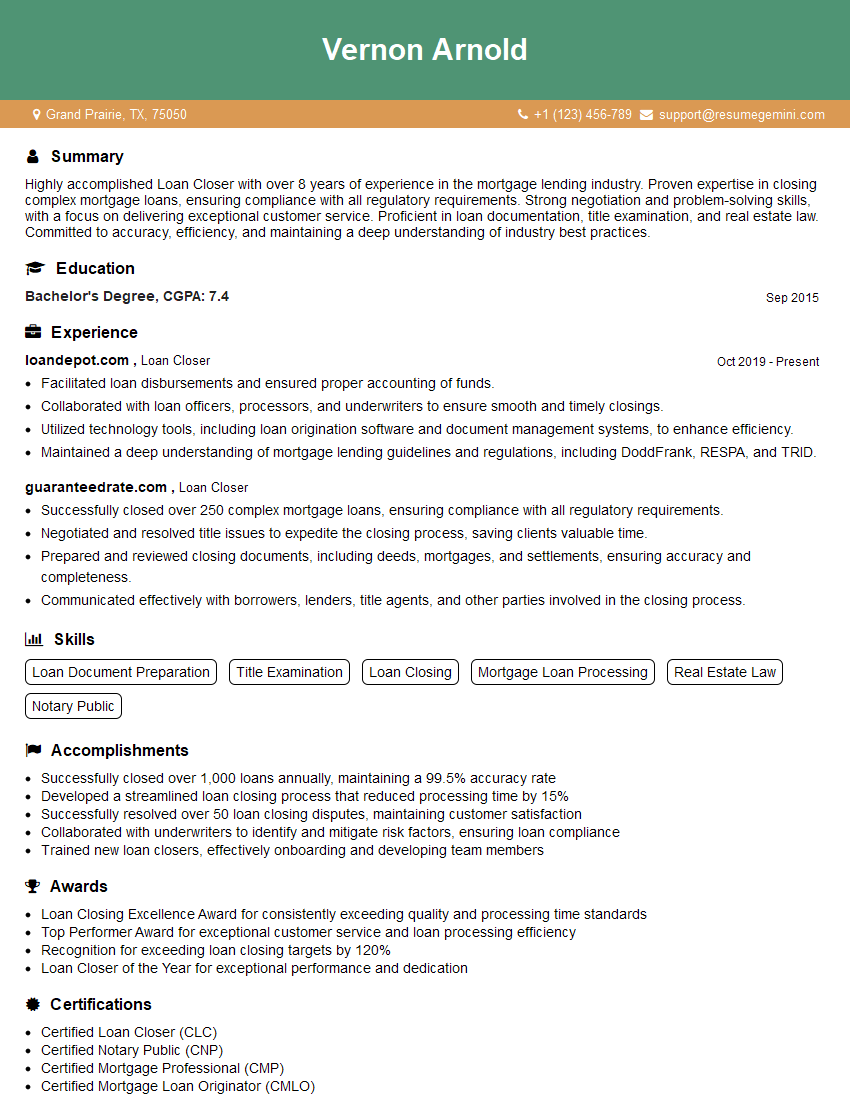

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Loan Closer

1. Describe the process of preparing a loan closing package for a residential mortgage loan?

- Review loan documents to ensure completeness and accuracy.

- Prepare closing disclosure and other required documents.

- Coordinate with lender, borrower, and other parties involved in the closing.

- Schedule and prepare for the closing.

- Witness the borrower’s signature on closing documents.

- Disburse loan proceeds and record closing documents.

2. Explain the role of a loan closer in the mortgage lending process.

Managing the Closing Process

- Coordinate and prepare all aspects of the closing.

- Ensure loan documents are complete and meet regulatory requirements.

- Schedule and conduct the closing meeting.

Facilitating Communication

- Communicate with borrowers, lenders, real estate agents, and other parties.

- Provide clear and timely updates on the closing process.

- Address any questions or concerns from involved parties.

3. How do you handle discrepancies or missing information in loan closing documents?

- Identify discrepancies and missing information promptly.

- Contact the appropriate party (lender, borrower, attorney) to obtain the necessary information.

- Work with the parties involved to resolve discrepancies and obtain missing documents.

4. What are the key regulatory requirements and compliance issues that loan closers need to be aware of?

- Truth in Lending Act (TILA)

- Real Estate Settlement Procedures Act (RESPA)

- Fair and Accurate Credit Transactions Act (FACTA)

- Loan Originator Compensation Rule (LOCR)

- Anti-Money Laundering (AML) regulations

5. How do you maintain confidentiality and protect sensitive borrower information?

- Adhere to the company’s privacy and security policies.

- Handle borrower information with the utmost discretion.

- Use secure methods to store and transmit sensitive data.

- Report any suspicious activity or potential security breaches promptly.

6. Describe your experience in working with different types of loan products.

- Conventional loans (FHA, VA, USDA)

- Refinance loans

- Jumbo loans

- Reverse mortgages

- Construction loans

7. What is your understanding of the role of technology in the mortgage closing process?

- Electronic document signing (e-signatures)

- Automated loan closing platforms

- Secure document sharing tools

- Artificial intelligence (AI) for document review

8. How do you stay up-to-date with the latest industry regulations and best practices?

- Attend industry conferences and webinars

- Read professional publications and articles

- Network with other loan professionals

- Participate in continuing education programs

9. Describe your customer service philosophy and how you apply it to your work as a loan closer.

- Provide exceptional customer service by being responsive, courteous, and professional.

- Communicate clearly and effectively with borrowers and other parties involved in the closing.

- Resolve issues quickly and efficiently to ensure a smooth closing process.

- Go above and beyond to meet the needs of my customers.

10. What are your goals for your career as a loan closer?

- Maintain a strong track record of successful loan closings.

- Gain experience in a variety of loan products and industry best practices.

- Contribute to the success of my team and organization.

- Become a trusted and respected loan professional.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Loan Closer.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Loan Closer‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

The Loan Closer plays a crucial role in the mortgage process, ensuring a smooth and successful closing experience for borrowers and lenders. Their responsibilities encompass a wide range of tasks, including:

1. Preparing Loan Closing Documents

Loan Closers are responsible for preparing and reviewing all necessary loan closing documents, including deeds, mortgages, and other legal agreements. They must verify that all information is accurate and complete, and that the documents are properly executed by all parties involved.

2. Conducting Loan Closing Meetings

Loan Closers conduct loan closing meetings, where they explain the loan terms and conditions to borrowers and ensure that they understand and agree to the terms of the loan. They also collect signatures on loan documents and witness the closing process.

3. Disbursing Loan Funds

Loan Closers are responsible for disbursing loan funds to borrowers and lenders. They ensure that all necessary payments are made, including closing costs, lender fees, and borrower expenses.

4. Recording and Tracking Loan Documents

Loan Closers record and track all loan documents, including deeds, mortgages, and other legal agreements. They ensure that all documents are properly filed and recorded in accordance with state and local laws.

Interview Tips

Preparing for a Loan Closer interview requires a combination of research, practice, and a positive mindset. Here are a few tips to help you ace the interview:

1. Research the Company and the Role

Before your interview, take the time to research the company and the specific Loan Closer role. Understand the company’s mission, values, and the responsibilities associated with the position. This knowledge will help you demonstrate your interest and enthusiasm during the interview.

2. Practice Your Answers

Anticipate common interview questions and prepare your answers in advance. Practice delivering your answers out loud to gain confidence and ensure that you can articulate your experience and qualifications effectively.

3. Highlight Your Attention to Detail

Loan Closers must have a keen eye for detail and accuracy. During your interview, emphasize your ability to meticulously review loan documents and your commitment to ensuring that all legal requirements are met.

4. Demonstrate Your Communication and Interpersonal Skills

Loan Closers often interact with borrowers, lenders, and other professionals. Showcase your excellent communication and interpersonal skills by providing examples of how you have effectively communicated complex information and built strong relationships with clients.

5. Be Enthusiastic and Professional

Throughout the interview, maintain a positive and professional demeanor. Show your enthusiasm for the role and your desire to contribute to the company’s success. Remember to dress appropriately and arrive punctually for the interview.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Loan Closer role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.