Feeling lost in a sea of interview questions? Landed that dream interview for Mortgage Closing Clerk but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Mortgage Closing Clerk interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

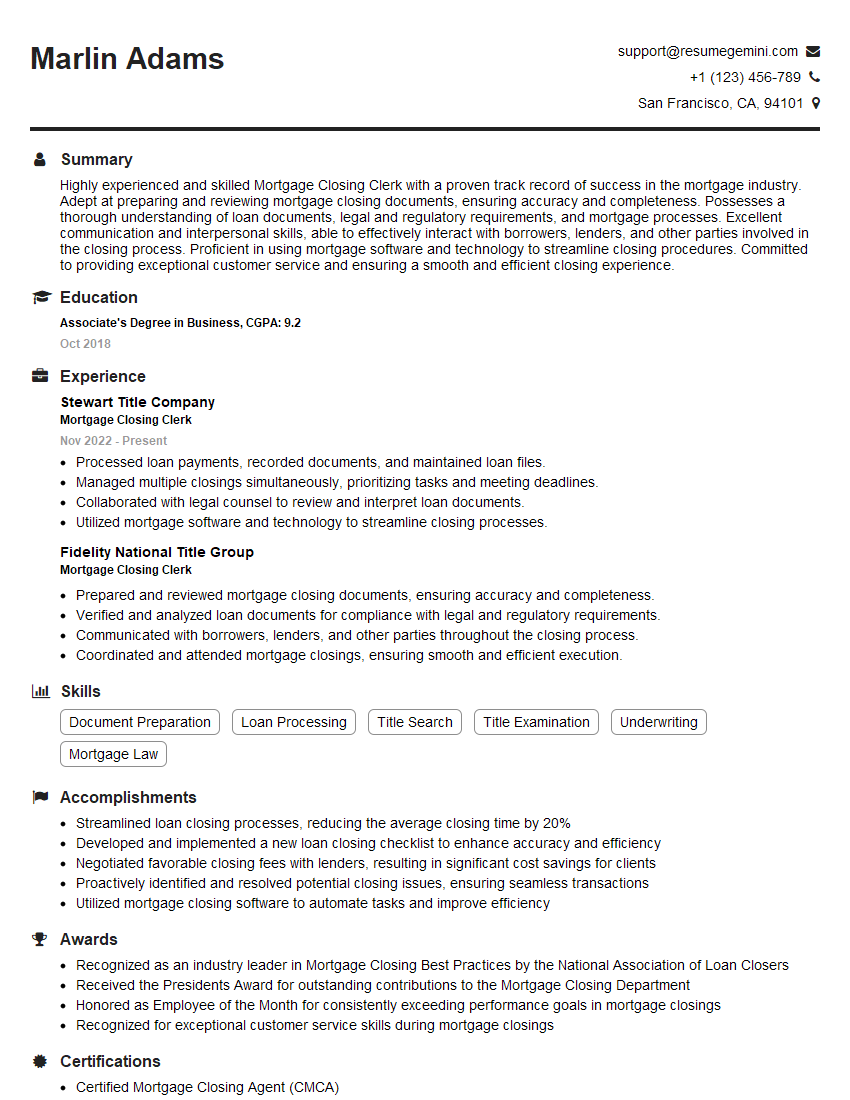

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Mortgage Closing Clerk

1. What are the key responsibilities of a Mortgage Closing Clerk?

As a professional Mortgage Closing Clerk, my responsibilities include:

- Preparing and reviewing loan closing documents to ensure accuracy and completeness

- Coordinating with borrowers, lenders, attorneys, and real estate agents to schedule and conduct loan closings

- Explaining loan terms and conditions to borrowers and answering their questions

- Collecting and disbursing funds as per loan instructions

- Ensuring compliance with all applicable laws and regulations

2. Describe your experience in processing and preparing mortgage loan closing packages.

Document Preparation

- Reviewing title reports, surveys, and other loan documentation

- Preparing closing statements, deeds, mortgages, and other closing documents

- Ensuring that all required signatures and notarizations are obtained

Package Assembly

- Organizing and assembling complete loan closing packages

- Reviewing packages for accuracy and completeness before submitting them to borrowers

- Communicating with borrowers and other parties to resolve any issues

3. How do you handle discrepancies or errors in loan closing documents?

- Identify and verify the discrepancy or error

- Communicate with the appropriate parties (lender, borrower, attorney) to discuss the issue

- Work with the parties to resolve the discrepancy and correct the error

- Update the loan closing documents and ensure that all parties sign and approve the changes

- Document the resolution and any necessary corrective actions

4. What steps do you take to ensure the security and confidentiality of borrower information?

- Storing sensitive documents in a secure location

- Using encryption software to protect electronic data

- Limiting access to information to authorized personnel only

- Shredding or incinerating documents containing sensitive information

- Following established policies and procedures for handling confidential information

5. Describe your experience with different types of mortgage loans.

- Conventional loans (conforming and non-conforming)

- Government-insured loans (FHA, VA, USDA)

- Jumbo loans

- Reverse mortgages

- Construction loans

6. How do you prioritize and manage multiple closing files simultaneously?

- Assessing the urgency and complexity of each file

- Creating a prioritized list of tasks

- Delegating tasks to other team members when necessary

- Communicating regularly with all parties involved

- Using technology tools to track progress and stay organized

7. What are the most challenging aspects of being a Mortgage Closing Clerk?

- Meeting tight deadlines under pressure

- Handling discrepancies and errors in loan closing documents

- Dealing with difficult or uncooperative borrowers

- Staying up-to-date with industry regulations and best practices

- Balancing the demands of multiple clients and projects

8. How do you contribute to the overall success of the lending team?

- Providing accurate and timely information to borrowers and other team members

- Ensuring that all loan closing documents are prepared and executed correctly

- Maintaining a professional and courteous demeanor with all parties involved

- Identifying and resolving potential issues early on

- Continuously seeking opportunities to improve processes and efficiency

9. What software and technology tools are you proficient in using?

- Loan origination software (LOS)

- Document preparation software

- Electronic signature platforms

- Communication and collaboration tools (email, instant messaging, video conferencing)

- Customer relationship management (CRM) systems

10. Why are you interested in joining our company?

I am very impressed with your company’s reputation for excellence in the lending industry. I believe that my skills and experience in mortgage closing can add value to your team and help you continue to provide exceptional service to your clients. I am eager to contribute to the success of your company and grow my career in this field.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Mortgage Closing Clerk.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Mortgage Closing Clerk‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Mortgage Closing Clerks play a crucial role in the mortgage industry by ensuring that all the necessary paperwork is completed and processed for mortgage closings. Their primary responsibilities include handling the preparation, review, verification, and processing of loan closing documents, ensuring accuracy and compliance with legal and regulatory standards.

1. Document Preparation and Processing

Mortgage Closing Clerks are responsible for preparing and processing various loan closing documents such as deeds, mortgages, notes, and settlement statements. They gather the necessary information from borrowers, lenders, and other parties, ensuring completeness and accuracy of the documents.

- Prepare and assemble loan closing packages, including mortgage documents, closing statements, and other required paperwork.

- Review and verify loan documentation for accuracy, completeness, and compliance with legal requirements.

- Calculate and process loan closing costs, including title fees, recording fees, and other expenses.

2. Communication and Coordination

Effective communication and coordination with various parties involved in the mortgage closing process are essential. Mortgage Closing Clerks act as the primary point of contact for borrowers, lenders, realtors, and attorneys.

- Communicate with borrowers to schedule closing appointments and provide updates on the loan closing process.

- Coordinate with lenders and attorneys to ensure timely delivery of loan documentation and other required materials.

- Liaise with realtors to obtain property details and information on the sale transaction.

3. Regulatory Compliance and Security

Mortgage Closing Clerks must adhere to strict regulatory compliance and security protocols to protect sensitive financial information and personal data. They are responsible for maintaining the confidentiality of loan documentation and ensuring compliance with industry regulations.

- Follow established procedures and guidelines to ensure compliance with federal and state lending laws.

- Protect and maintain the confidentiality of borrower and lender information, including financial documents and personal data.

- Implement security measures to safeguard sensitive loan closing documents and prevent unauthorized access.

4. Customer Service and Support

Mortgage Closing Clerks play a pivotal role in providing exceptional customer service to borrowers. They are responsible for ensuring that borrowers understand the loan closing process and that their questions and concerns are addressed promptly.

- Provide clear and concise explanations of loan closing procedures and documentation to borrowers.

- Answer questions and address concerns from borrowers and other parties involved in the closing process.

- Maintain a professional and courteous demeanor throughout the mortgage closing experience.

Interview Tips

Preparing thoroughly for a Mortgage Closing Clerk interview can significantly increase your chances of success. Here are some essential interview tips and hacks to help you ace the interview:

1. Research the Company and Position

Before the interview, take the time to research the lending institution and the specific Mortgage Closing Clerk position. Understand their company culture, values, and the specific responsibilities and requirements of the role.

- Visit the company’s website to gather information about their history, services, and recent news.

- Review the job description thoroughly to identify key responsibilities and qualifications.

- Use online resources such as LinkedIn and Glassdoor to learn more about the company and the position.

2. Highlight Your Skills and Experience

During the interview, emphasize your relevant skills and experience that align with the Mortgage Closing Clerk role. Quantify your accomplishments and provide concrete examples of your work.

- Showcase your experience in document preparation, review, and processing, especially in the mortgage industry.

- Highlight your strong communication and interpersonal skills, emphasizing your ability to interact effectively with borrowers, lenders, and other parties.

- Demonstrate your understanding of regulatory compliance and security protocols related to mortgage closings.

3. Prepare for Common Interview Questions

Familiarize yourself with common interview questions and prepare thoughtful answers that showcase your qualifications. Some typical questions you may encounter include:

- Tell us about your experience in mortgage closing or a similar role.

- Describe your understanding of the mortgage closing process.

- How do you ensure accuracy and completeness in your work?

4. Practice Your Answers and Ask Questions

To gain confidence and polish your delivery, practice answering interview questions out loud. You can use a mirror or record yourself to observe your body language and presentation. Additionally, prepare questions to ask the interviewer, which demonstrates your interest and engagement in the role.

- Rehearse your answers to potential interview questions, focusing on clarity, conciseness, and relevance.

- Prepare thoughtful questions to ask the interviewer, such as the company’s growth plans or their commitment to customer service.

- By asking informed questions, you can show your interest in the position and the company.

5. Dress Professionally and Arrive on Time

First impressions matter, so dress professionally and arrive for your interview on time. This demonstrates respect for the interviewer and the company.

- Choose business attire that is clean, pressed, and appropriate for an office setting.

- Plan your route in advance and allow ample time to arrive at the interview location without rushing.

- Being punctual and well-dressed shows that you value the interviewer’s time and that you are serious about the opportunity.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Mortgage Closing Clerk interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!